Embark on a journey into the world of Portfolio Performance Evaluation, where we unravel the intricacies of assessing investment performance with precision and insight.

From understanding key metrics to exploring diverse evaluation methods, this topic delves into the heart of investment decision-making.

Overview of Portfolio Performance Evaluation

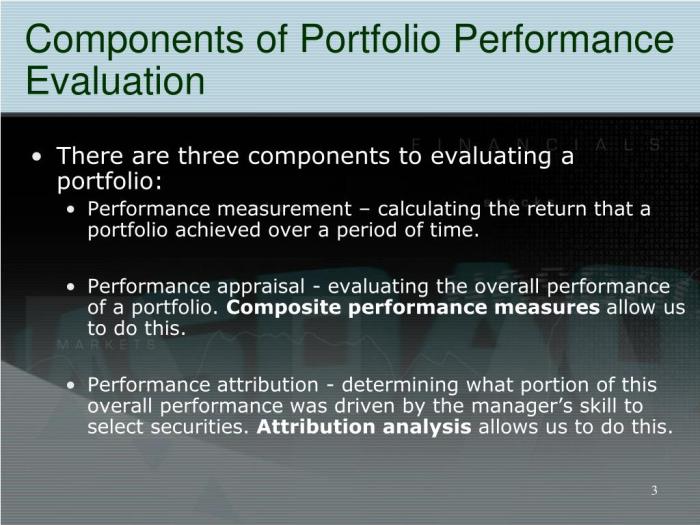

Portfolio Performance Evaluation is the process of assessing the return and risk of an investment portfolio over a specific period. This analysis helps investors understand how well their investments are performing and whether they are meeting their financial goals.

Importance of Evaluating Portfolio Performance

Evaluating portfolio performance is crucial for several reasons. It allows investors to:

- Track the progress towards their investment objectives

- Identify underperforming assets and make necessary adjustments

- Compare the portfolio’s performance against relevant benchmarks

- Assess the effectiveness of the investment strategy

Key Metrics Used in Evaluating Portfolio Performance

There are several key metrics used in evaluating portfolio performance, including:

| 1. Return on Investment (ROI) | Measures the gain or loss generated on an investment relative to the amount invested. |

| 2. Sharpe Ratio | Evaluates the risk-adjusted return of a portfolio. |

| 3. Standard Deviation | Measures the volatility of returns in a portfolio. |

| 4. Alpha | Indicates the excess return of a portfolio compared to its benchmark. |

Role of Portfolio Performance Evaluation in Investment Decisions

Portfolio performance evaluation plays a critical role in guiding investment decisions by providing valuable insights into the effectiveness of the investment strategy. It helps investors make informed choices about asset allocation, risk management, and overall portfolio optimization.

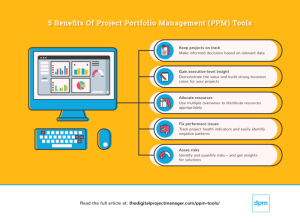

Methods for Portfolio Performance Evaluation

Portfolio performance evaluation is crucial for investors to assess the effectiveness of their investment strategies. There are various methods used to evaluate portfolio performance, including time-weighted and money-weighted rates of return, risk-adjusted performance measures, and benchmarking.

Time-weighted and Money-weighted Rates of Return

Time-weighted rate of return is a measure that eliminates the impact of cash flows on the performance of a portfolio. It is calculated by geometrically linking the sub-period returns. On the other hand, money-weighted rate of return takes into account the timing and amount of cash flows into and out of the portfolio. This method reflects the actual performance experienced by the investor.

Significance of Risk-adjusted Performance Measures

Risk-adjusted performance measures are essential in evaluating portfolios as they consider the level of risk taken to achieve a certain return. One common risk-adjusted measure is the Sharpe ratio, which evaluates the excess return of a portfolio relative to its risk. Another measure is the Treynor ratio, which assesses the excess return per unit of systematic risk taken.

Benchmarking in Portfolio Performance Evaluation

Benchmarking involves comparing the performance of a portfolio against a specified benchmark, such as an index or a peer group. This helps investors understand how well their portfolio is performing relative to a predefined standard. By benchmarking, investors can identify areas of strength and weakness in their investment strategies and make informed decisions to improve performance.

Portfolio Diversification

Portfolio diversification is a risk management strategy that involves spreading investments across different asset classes to reduce exposure to any single asset. It is a crucial component of investment management as it helps in minimizing risk while maximizing returns.Diversifying a portfolio across different asset classes offers several benefits. Firstly, it helps in reducing the overall risk of the portfolio by spreading investments across various assets that may have different risk-return profiles.

This means that if one asset underperforms, the impact on the overall portfolio is minimized as other assets may perform better.Furthermore, diversification can also enhance returns by capturing the performance of different asset classes that may outperform each other at different times. By having a mix of assets such as stocks, bonds, real estate, and commodities, investors can benefit from the potential growth in various sectors of the economy.One of the key ways diversification helps in reducing risk is through correlation.

Correlation measures how closely the price movements of different assets are related. By investing in assets that have low or negative correlation, investors can further reduce the overall risk of the portfolio.Effective portfolio diversification can be achieved through various strategies. One common approach is to allocate investments across different asset classes such as equities, fixed income, real estate, and alternative investments.

Another strategy is to diversify geographically by investing in assets from different regions or countries to reduce exposure to any single market.Overall, portfolio diversification is a fundamental principle in investment management that helps in reducing risk and enhancing returns by spreading investments across different asset classes and sectors.

Portfolio Management

Portfolio management is the process of overseeing and maintaining a portfolio to achieve the desired investment objectives. It involves making strategic decisions about asset allocation, risk management, and rebalancing to ensure the portfolio aligns with the investor’s goals.

Asset Allocation

Asset allocation is a key aspect of portfolio management that involves determining the mix of assets (such as stocks, bonds, and cash) in the portfolio. By diversifying investments across different asset classes, investors can manage risk and maximize returns.

Risk Management

Risk management in portfolio management involves assessing and mitigating the various risks associated with investing. This includes market risk, credit risk, liquidity risk, and more. By diversifying the portfolio and using risk management techniques, investors can protect their investments from potential losses.

Rebalancing

Rebalancing is the process of adjusting the portfolio’s asset allocation to maintain the desired risk and return profile. This involves selling overperforming assets and buying underperforming assets to bring the portfolio back in line with the target allocation.

Setting Investment Objectives

Setting clear investment objectives is crucial in portfolio management as it provides a roadmap for making investment decisions. Objectives can include goals such as capital preservation, income generation, or capital appreciation. By defining these objectives, investors can align their portfolio with their financial goals.

Impact of Market Conditions

Market conditions play a significant role in portfolio management decisions. Changes in interest rates, economic indicators, geopolitical events, and market sentiment can impact the performance of investments. Portfolio managers must stay informed about market conditions and adjust their strategies accordingly to navigate changing market dynamics.

In conclusion, Portfolio Performance Evaluation serves as a crucial tool in navigating the complexities of investment management, ensuring informed decisions and optimal returns.

Commonly Asked Questions

What is Portfolio Performance Evaluation?

Portfolio Performance Evaluation involves assessing the success of investments within a portfolio using various metrics and benchmarks.

How does diversification impact portfolio performance?

Diversification helps in reducing risk by spreading investments across different asset classes, thus enhancing overall returns.

Why is benchmarking important in evaluating portfolios?

Benchmarking provides a standard for comparing portfolio performance against market indices or specific investment strategies, aiding in performance assessment.

What role does risk-adjusted performance measures play in evaluation?

Risk-adjusted performance measures account for the level of risk taken to achieve returns, offering a more balanced view of portfolio performance.