Embark on a journey into mastering optimal diversification, a crucial aspect of successful investing. This introduction sets the stage for a deep dive into the world of portfolio diversification, shedding light on key strategies and considerations that can lead to financial success.

Exploring the nuances of asset allocation, risk reduction, and portfolio management, this guide aims to equip you with the knowledge needed to make informed investment decisions.

Introduction to Portfolio Diversification

Portfolio diversification is a strategy used by investors to spread their investments across different asset classes, industries, and geographical regions. The goal is to reduce risk by not putting all your eggs in one basket. Diversification is crucial in investing because it helps minimize the impact of volatility in any single investment on the overall portfolio.

Benefits of Diversification

- Diversification helps lower the overall risk of the portfolio by spreading investments across various assets.

- It can potentially enhance returns by capturing upside potential in different sectors or regions.

- Reduces the impact of a single asset’s poor performance on the entire portfolio.

Examples of Diversification Impact

- During a market downturn, a portfolio heavily concentrated in a single sector like technology would suffer more significant losses compared to a diversified portfolio that includes other sectors like healthcare, consumer goods, and utilities.

- Geographical diversification can protect against country-specific risks, such as political instability or economic downturns in a particular region.

- Investing in a mix of stocks, bonds, and real estate can provide a well-rounded portfolio that balances risk and return potential.

Strategies for Achieving Optimal Diversification

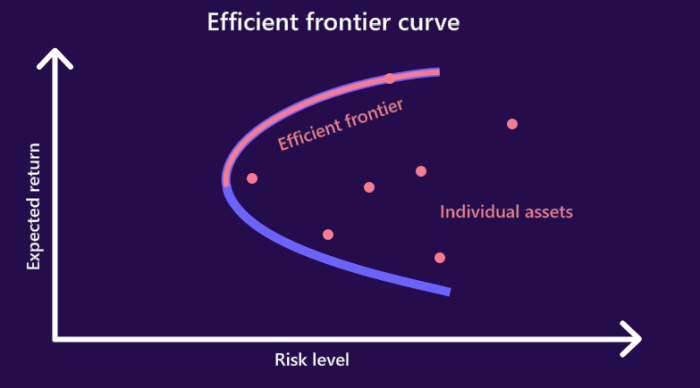

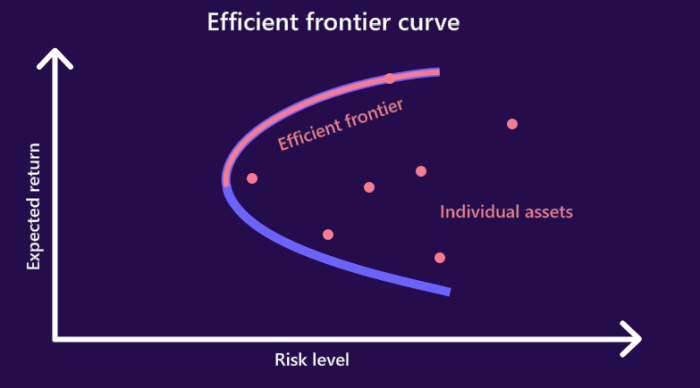

When it comes to achieving optimal diversification in your investment portfolio, one of the key strategies is asset allocation. Asset allocation involves spreading your investments across different asset classes to reduce risk and maximize returns.

Asset Allocation and its Role in Diversification

Asset allocation is the practice of dividing your investment portfolio among different asset classes such as stocks, bonds, real estate, and cash equivalents. By diversifying across asset classes, you can reduce the impact of market fluctuations on your overall portfolio performance.

Diversification Within Asset Classes vs. Across Asset Classes

Diversification within asset classes involves spreading your investments within the same asset class, such as investing in multiple stocks or multiple bonds. On the other hand, diversification across asset classes involves investing in different types of assets to spread risk more broadly.

Examples of Diversified Portfolios with Varying Risk Levels

- A conservative portfolio might include a mix of bonds, cash equivalents, and a small percentage of stocks. This type of portfolio is suitable for investors with a low risk tolerance.

- A moderate portfolio could consist of a balanced mix of stocks and bonds, with a slightly higher allocation to stocks. This type of portfolio is suitable for investors with a moderate risk tolerance.

- An aggressive portfolio might have a higher allocation to stocks and alternative investments, with a smaller percentage allocated to bonds. This type of portfolio is suitable for investors with a high risk tolerance.

Factors to Consider for Effective Diversification

Effective diversification involves careful consideration of various factors to ensure a well-balanced and risk-managed investment portfolio. Let’s explore some key factors to consider:

Types of Investment Assets Suitable for Diversification

- Diversifying across different asset classes such as stocks, bonds, real estate, and commodities can help spread risk.

- Including both domestic and international investments can provide exposure to different markets and economies.

- Alternative investments like hedge funds, private equity, and venture capital can further enhance diversification.

Importance of Correlation Among Assets in a Diversified Portfolio

- Correlation measures the relationship between the returns of different assets. Low or negative correlation can help reduce overall portfolio risk.

- Including assets with uncorrelated or negatively correlated returns can improve the stability of a diversified portfolio.

- Correlation analysis is essential to avoid over-concentration in assets that move in tandem during market fluctuations.

Risk Tolerance and Investment Goals Influence Diversification Strategies

- Understanding your risk tolerance is crucial in determining the mix of assets in your portfolio. Higher risk tolerance may allow for more aggressive investments.

- Aligning diversification strategies with specific investment goals, such as retirement planning or wealth preservation, can lead to better long-term outcomes.

- Regularly reassessing risk tolerance and adjusting diversification strategies as goals evolve is key to maintaining an optimal portfolio mix.

Portfolio Management Techniques

Maintaining a diversified portfolio involves various techniques that help investors manage risk and optimize returns. One key aspect of portfolio management is rebalancing, which plays a crucial role in ensuring that the portfolio remains diversified and aligned with the investor’s goals and risk tolerance.

Role of Rebalancing

Rebalancing involves periodically adjusting the allocation of assets in a portfolio to bring it back to its target mix. This is necessary because over time, market fluctuations can cause the original asset allocation to drift, leading to an imbalance in the portfolio. By rebalancing, investors can restore the desired level of diversification and risk exposure.

- Rebalancing helps investors buy low and sell high by selling assets that have performed well and buying assets that are undervalued.

- It allows investors to maintain their risk profile by adjusting the portfolio in response to changing market conditions.

- Regular rebalancing prevents the portfolio from becoming too concentrated in a few assets, reducing the overall risk exposure.

Impact of Market Conditions

Market conditions play a significant role in portfolio diversification, as different assets may perform differently under varying economic environments. During periods of market volatility or economic uncertainty, correlations between assets may increase, affecting the effectiveness of diversification strategies.

- Highly correlated assets may move in the same direction during market downturns, reducing the benefits of diversification.

- Diversification may be challenged during times of extreme market stress when correlations tend to converge.

- Market conditions can influence the performance of different asset classes, impacting the overall risk and return profile of the portfolio.

Monitoring and Adjusting a Diversified Portfolio

Monitoring and adjusting a diversified portfolio over time is essential to ensure that it remains aligned with the investor’s objectives and risk tolerance. Regular review and adjustments can help investors capitalize on opportunities and mitigate risks in changing market environments.

- Monitor the performance of individual assets and the overall portfolio regularly to assess if the current allocation is still appropriate.

- Consider changes in market conditions, economic outlook, and investment goals when making adjustments to the portfolio.

- Review the asset allocation and rebalance the portfolio periodically to maintain diversification and manage risk effectively.

In conclusion, achieving optimal diversification is not just about spreading your investments across different assets—it’s about understanding the intricate balance between risk and return. By implementing the strategies and techniques discussed, you can navigate the complexities of the financial markets with confidence and precision.

Questions Often Asked

What are the key benefits of diversification?

Diversification helps in reducing risk by spreading investments across different assets, minimizing the impact of market fluctuations on your portfolio.

How does risk tolerance influence diversification strategies?

Risk tolerance determines the level of risk an investor is comfortable with, which in turn shapes the asset allocation and diversification approach in their investment portfolio.

Why is rebalancing important in portfolio management?

Rebalancing ensures that your portfolio maintains the desired asset allocation over time, helping you stay aligned with your investment goals.