Embark on a journey through the world of Global Portfolio Diversification, where the power of spreading investments across borders unfolds to optimize gains and shield against uncertainties.

Explore the intricacies of diversifying globally and discover the key benefits that await savvy investors.

Introduction to Global Portfolio Diversification

Global portfolio diversification refers to the strategy of spreading investments across various countries and regions to reduce risk and enhance potential returns. By investing in different markets, asset classes, and industries worldwide, investors can minimize the impact of local economic downturns or geopolitical events on their overall portfolio performance.Diversifying investments globally is essential for several reasons. Firstly, it helps to mitigate country-specific risks such as political instability, regulatory changes, or currency fluctuations.

By spreading investments across different regions, investors can minimize the impact of any adverse events in a single market. Additionally, global diversification allows investors to take advantage of growth opportunities in emerging markets while maintaining exposure to more stable developed economies.One example of how global portfolio diversification can mitigate risk is during times of economic recession. If an investor’s portfolio is heavily concentrated in one country that is experiencing an economic downturn, their entire investment could be at risk.

However, by diversifying globally, the negative impact of a recession in one region can be offset by positive performance in other regions that are not as heavily affected.

Benefits of Global Portfolio Diversification

- Diversification across different markets reduces exposure to country-specific risks.

- Opportunity to capitalize on growth in emerging markets while maintaining stability from developed economies.

- Minimization of impact from economic downturns or geopolitical events in a single region.

Benefits of Global Portfolio Diversification

Global portfolio diversification can offer several benefits to investors looking to optimize their investment strategy and manage risk effectively. By spreading investments across different markets and asset classes, investors can potentially enhance their returns while reducing overall portfolio volatility.Diversification helps mitigate the risks associated with focusing investments in a single market. For example, if an investor heavily invests in one country or industry, they are more susceptible to the economic and geopolitical factors specific to that region.

By diversifying globally, investors can reduce the impact of localized risks on their portfolio performance.Moreover, global diversification provides exposure to different economies and industries, allowing investors to capitalize on growth opportunities worldwide. This exposure can help investors benefit from the performance of sectors that may not be prevalent in their home market, thus enhancing the overall diversification of their portfolio.

Enhanced Returns through Global Diversification

- Access to growth opportunities in emerging markets

- Ability to capitalize on sector-specific strengths in different regions

- Potential for higher returns due to reduced correlation among global markets

Risk Mitigation and Stability

- Diversification reduces the impact of market-specific events on the overall portfolio

- Helps manage currency risk through exposure to multiple currencies

- Enhances portfolio resilience during market downturns

Strategies for Global Portfolio Diversification

Global portfolio diversification can be achieved through various strategies tailored to individual investor goals and risk tolerance. One key aspect to consider is the mix of assets in the portfolio, which can help spread risk and enhance potential returns. Let’s explore some strategies for effective global portfolio diversification.

Passive vs. Active Global Diversification Approaches

Passive global diversification involves investing in index funds or exchange-traded funds (ETFs) that track a specific market index. This approach aims to replicate the performance of the overall market without actively selecting individual securities. On the other hand, active global diversification involves hands-on management of the portfolio by a professional fund manager who seeks to outperform the market through strategic asset selection and timing.

- Passive Diversification:

- Low cost due to minimal trading activity

- Reduced risk of underperforming the market

- Easy to maintain and requires less time commitment

- Active Diversification:

- Potential for higher returns through skilled management

- Opportunity to capitalize on market inefficiencies

- Flexibility to adjust the portfolio based on market conditions

It’s essential to consider your risk tolerance, investment goals, and time horizon when deciding between passive and active global diversification approaches.

Role of Asset Allocation in Global Portfolio Diversification

Asset allocation plays a crucial role in global portfolio diversification as it involves spreading investments across different asset classes such as stocks, bonds, real estate, and commodities. By diversifying across various asset classes, investors can reduce the overall risk of their portfolio while potentially enhancing returns.

- Equity Allocation:

- Provides growth potential but comes with higher volatility

- Diversification across industries, sectors, and regions can mitigate risk

- Fixed-Income Allocation:

- Offers stability and income through bond investments

- Helps cushion the portfolio during market downturns

- Alternative Investments:

- Includes real estate, commodities, and hedge funds

- Can provide diversification benefits and non-correlated returns

Striking the right balance in asset allocation based on your risk profile and investment objectives is key to successful global portfolio diversification.

Risk Management in Global Portfolio Diversification

Global portfolio diversification plays a crucial role in managing risk by spreading investments across different asset classes, industries, and geographic regions. This strategy helps reduce the impact of market fluctuations on the overall portfolio.

Correlation Among Assets in a Diversified Portfolio

Correlation refers to the relationship between the price movements of different assets in a portfolio. When assets are highly correlated, they tend to move in the same direction. In a diversified portfolio, assets with low or negative correlations can help offset losses in one asset class with gains in another. This lowers the overall risk of the portfolio.

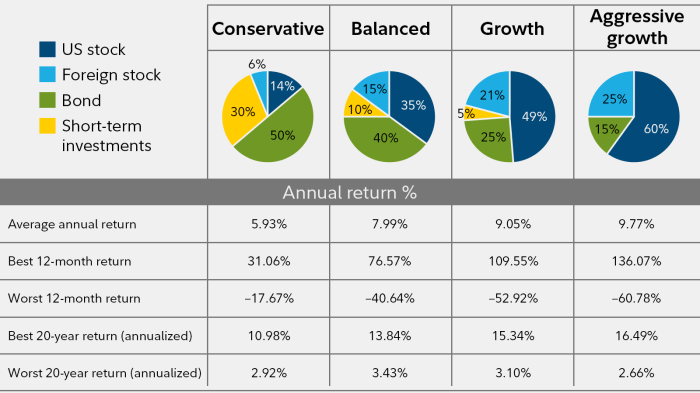

Reducing Volatility through Global Diversification

Global diversification can reduce volatility by spreading investments across various markets that may not move in sync with each other. For example, during times of economic downturn in one region, investments in another region that is experiencing growth can help balance out losses. By diversifying globally, investors can potentially lower the overall volatility of their portfolio.

PORTFOLIO DIVERSIFICATION

Portfolio diversification is a strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce risk and improve returns. It is a crucial aspect of investment management as it helps in minimizing the impact of volatility in any particular asset or market segment. By diversifying your portfolio, you can potentially enhance your long-term investment performance while mitigating risk.

Importance of Portfolio Diversification

Diversification is important because it helps in spreading risk across different investments, reducing the impact of any single asset’s poor performance on the overall portfolio. A well-diversified portfolio can provide a more stable and consistent return over time, as compared to a concentrated portfolio that is heavily weighted in a few investments. By diversifying, investors can protect themselves from unforeseen events or market downturns that may affect specific sectors or asset classes.

- Diversification spreads risk: By investing in a variety of assets, you can reduce the impact of negative events on your portfolio.

- Improved risk-adjusted returns: Diversification helps in achieving a balance between risk and return, leading to more stable and consistent performance.

- Enhanced long-term growth: By spreading investments across different sectors and regions, you can benefit from growth opportunities in various markets.

PORTFOLIO MANAGEMENT

Portfolio management involves the process of creating and maintaining an investment portfolio that aligns with an individual’s financial goals, risk tolerance, and time horizon. The key principles of portfolio management include diversification, asset allocation, and regular monitoring and rebalancing of the portfolio.

Role of Asset Allocation

Asset allocation is a crucial aspect of effective portfolio management as it involves distributing investments across different asset classes such as stocks, bonds, real estate, and commodities. By diversifying investments, asset allocation helps reduce overall risk in a portfolio and enhances the potential for returns. It also ensures that the portfolio is aligned with the investor’s risk tolerance and financial objectives.

Portfolio Rebalancing

Portfolio rebalancing plays a vital role in managing risk and returns by ensuring that the portfolio remains aligned with the investor’s goals and risk tolerance over time. This process involves periodically reviewing the portfolio’s asset allocation and making adjustments as necessary to bring it back to the target allocation. By selling overperforming assets and buying underperforming ones, portfolio rebalancing helps maintain the desired risk-return profile of the portfolio and prevents it from becoming too concentrated in a particular asset class.

In conclusion, Global Portfolio Diversification emerges as a strategic tool for navigating the complex landscape of investments, offering a balanced approach to secure long-term financial growth.

Key Questions Answered

What is the primary goal of global portfolio diversification?

The main aim is to optimize returns by spreading investments across various regions and asset classes to minimize risk exposure.

How does global portfolio diversification mitigate risk?

By investing in different markets and industries, it helps in reducing the impact of market-specific risks, offering a more balanced approach to wealth growth.

Is global portfolio diversification suitable for all types of investors?

While it can benefit most investors, it’s crucial to align strategies with individual risk tolerance, financial goals, and investment horizon.