Embark on a journey into Diversified Investment Funds, exploring how they can enhance your investment portfolio while minimizing risks, all in a clear and concise manner.

Delve deeper into the realm of diversified funds as we uncover the strategies and benefits that come with this investment approach.

Diversified Investment Funds

Diversified investment funds are financial products that pool money from multiple investors to invest in a wide range of securities such as stocks, bonds, and other assets. The main goal of these funds is to spread out the investment across various industries, sectors, and regions to reduce risk.

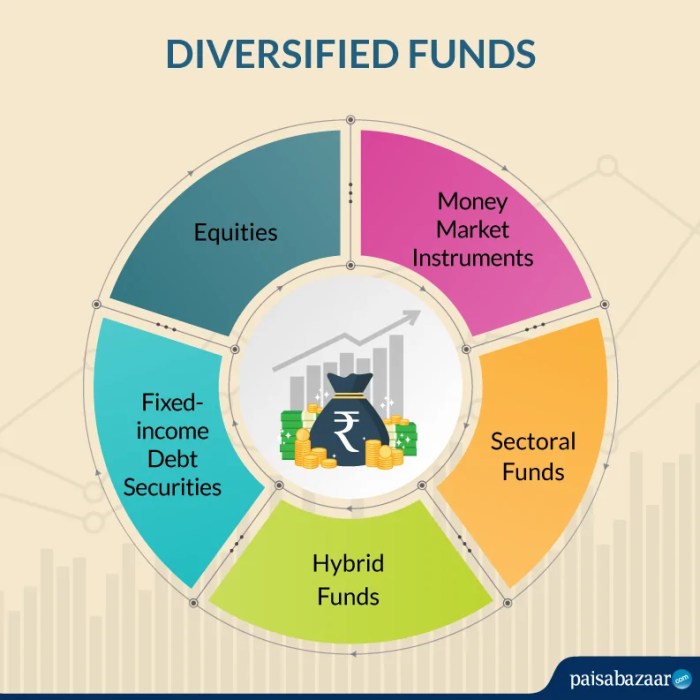

Types of Diversified Investment Funds

- Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500.

- Mutual Funds: Managed by professionals who select a diversified portfolio of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): Trade on stock exchanges like individual stocks and offer diversification benefits.

Benefits of Investing in Diversified Funds

Investing in diversified funds offers several benefits:

- Reduced Risk: By spreading investments across various assets, the impact of a single investment performing poorly is minimized.

- Portfolio Diversification: Provides exposure to different asset classes, sectors, and regions, reducing overall portfolio risk.

- Professional Management: Fund managers make investment decisions based on research and expertise, saving time and effort for individual investors.

Spreading Risk with Diversified Funds

Diversified investment funds help spread risk by investing in a wide range of assets. For example, if one stock in the portfolio underperforms, the negative impact on the overall fund’s performance is limited due to the presence of other well-performing investments. This risk mitigation strategy is crucial for long-term investment success.

Portfolio Diversification

Portfolio diversification is a strategy that involves spreading your investments across different assets to reduce risk and optimize returns. This approach aims to minimize the impact of any single investment performing poorly by having a mix of investments in various sectors and industries.

Role of Portfolio Diversification in Reducing Risk

Portfolio diversification plays a crucial role in reducing risk by ensuring that a downturn in one asset class does not significantly impact the overall performance of the portfolio. By spreading investments across different assets, such as stocks, bonds, real estate, and commodities, investors can minimize the risk of losing a substantial portion of their investment in case of a market fluctuation or economic downturn.

Diversifying Across Various Asset Classes for Optimal Returns

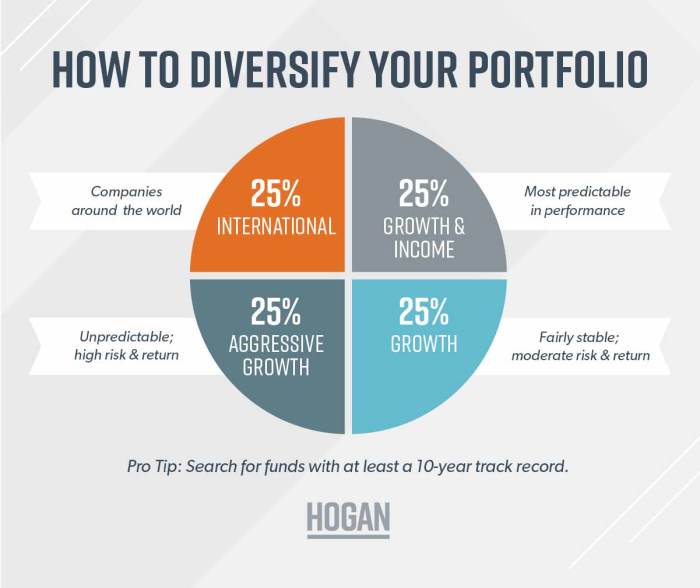

Diversifying across various asset classes can optimize returns by capturing the growth potential of different sectors while mitigating the risks associated with any single asset class. For example, while stocks may offer higher growth potential, bonds provide stability and income. By combining these assets in a diversified portfolio, investors can achieve a balance between risk and return, maximizing their overall investment performance.

Strategies for Effective Portfolio Diversification

- Determine your investment goals and risk tolerance before building your portfolio.

- Spread investments across different asset classes, such as equities, fixed income, real estate, and alternative investments.

- Allocate assets based on their correlation to reduce overall portfolio risk.

- Regularly rebalance your portfolio to maintain the desired asset allocation and risk level.

Portfolio Management

In the context of diversified investment funds, portfolio management refers to the strategic process of overseeing a collection of securities (stocks, bonds, etc.) to achieve the fund’s objectives while managing risks. Portfolio managers aim to create a diversified portfolio that optimizes returns based on the fund’s investment strategy.

Selection of Investments for Diversified Funds

Portfolio managers select investments for a diversified fund based on various factors such as the fund’s investment goals, risk tolerance, time horizon, and market conditions. They conduct thorough research and analysis to identify suitable assets that align with the fund’s objectives. Diversification across different asset classes, industries, and regions is crucial to reduce risk and enhance potential returns.

Importance of Active Management

Active management plays a vital role in maintaining a diversified portfolio by regularly monitoring and adjusting investments based on changing market conditions and opportunities. Portfolio managers actively seek to outperform the market through strategic asset allocation, stock selection, and risk management. This dynamic approach helps to capitalize on market trends and mitigate potential losses.

Impact of Market Trends on Portfolio Management Strategies

Market trends have a significant impact on portfolio management strategies as they influence asset prices, risk levels, and investment opportunities. Portfolio managers need to adapt to changing market conditions by adjusting the portfolio composition, reallocating assets, and hedging against risks. Staying informed about market trends and economic indicators is essential for making informed investment decisions and optimizing portfolio performance.

In conclusion, Diversified Investment Funds offer a well-rounded investment strategy that spreads risk and optimizes returns, making them a valuable asset in any investor’s toolkit.

Helpful Answers

How do diversified investment funds differ from traditional funds?

Diversified investment funds spread investments across various asset classes to reduce risk, unlike traditional funds that focus on specific sectors or industries.

Are diversified funds suitable for all types of investors?

Yes, diversified funds are ideal for both novice and experienced investors looking to minimize risk and maximize returns through a balanced portfolio.

What are the key benefits of investing in diversified funds?

Investing in diversified funds helps in spreading risk, enhancing portfolio stability, and optimizing returns through exposure to different market segments.

How can one effectively manage a diversified investment portfolio?

Effective portfolio management involves regular monitoring, rebalancing, and strategic asset allocation to maintain the desired level of diversification and risk management.

Can diversified investment funds protect against market fluctuations?

While not immune to market fluctuations, diversified funds offer a level of protection by spreading investments across multiple assets, reducing the impact of volatility.