Exploring the concept of Diversification in Investing, this introduction sets the stage for a deep dive into how diversifying your investments can lead to better financial outcomes. With a focus on minimizing risks and maximizing returns, this topic is essential for anyone looking to build a robust investment portfolio.

As we delve further into the importance of diversification and its impact on long-term financial goals, readers will gain valuable insights into effective investment strategies and asset allocation techniques.

Diversification in Investing

Diversification is a risk management strategy that involves spreading investments across different assets to reduce overall risk. It is an important concept in investing as it helps protect a portfolio from the negative impact of a single asset or market downturn.

Importance of Diversification

- Diversification can help reduce the risk of significant losses by not putting all your eggs in one basket.

- It allows investors to capture the returns of different asset classes that may perform well at different times.

- By diversifying, investors can potentially achieve a more stable and consistent return on their investments over the long term.

Asset Classes for Diversification

Investors can diversify their portfolio across various asset classes, such as:

- Stocks

- Bonds

- Real Estate

- Commodities

- Cash and Cash Equivalents

Benefits of Diversification

- Reduces overall portfolio risk by spreading investments across different assets.

- Helps in achieving long-term financial goals by balancing risk and return.

- Allows investors to take advantage of different market conditions and economic cycles.

Portfolio Diversification

Portfolio diversification is a risk management strategy that involves spreading investments across different asset classes to reduce exposure to any single asset or risk. It plays a crucial role in an investment strategy by minimizing the impact of market fluctuations on the overall portfolio performance.

Strategies for Effective Diversification

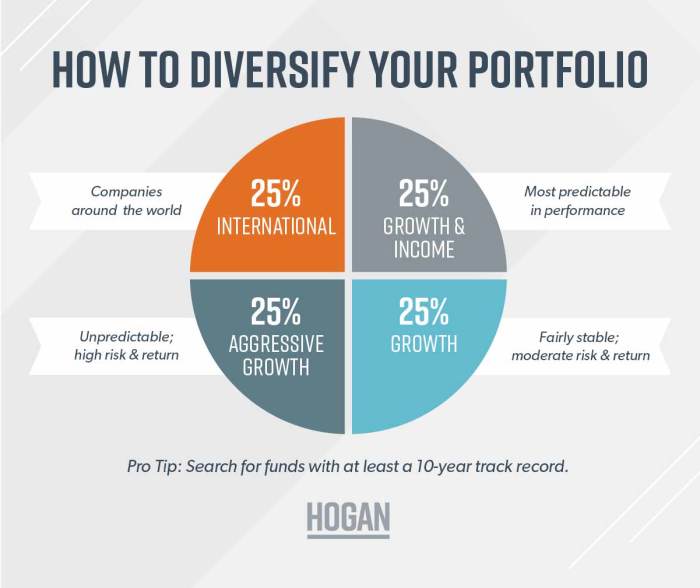

Diversifying a portfolio across various assets can be achieved through a combination of the following strategies:

- Asset Allocation: Allocating investments across different asset classes such as stocks, bonds, real estate, and commodities.

- Diversifying within Asset Classes: Investing in a mix of industries, sectors, and geographic regions to minimize concentration risk.

- Rebalancing: Regularly reviewing and adjusting the portfolio to maintain the desired asset allocation.

Impact of Correlation Between Assets

The correlation between assets measures how closely their prices move in relation to each other. Low or negative correlation between assets can enhance portfolio diversification as they may not move in the same direction during market fluctuations. However, assets with high positive correlation may not provide the desired diversification benefits.

Correlation coefficients close to +1 indicate a strong positive correlation, while coefficients close to -1 indicate a strong negative correlation.

Diversification for Managing Volatility

Diversification can help in managing volatility in a portfolio by spreading risk across different investments. When one asset underperforms, other assets in the portfolio may offset the losses, reducing the overall impact of market volatility. This can lead to a more stable and consistent portfolio performance over time.

Portfolio Management

Portfolio management involves the strategic management of an investor’s portfolio to achieve their financial goals while minimizing risks. It includes key principles that guide the decision-making process to ensure optimal performance.

Key Principles of Portfolio Management

- Diversification: Spreading investments across different asset classes to reduce risk.

- Asset Allocation: Determining the right mix of assets based on risk tolerance, investment goals, and time horizon.

- Risk Management: Monitoring and managing risks through proper diversification and asset allocation.

- Periodic Review: Regularly assessing the performance of the portfolio and making necessary adjustments.

Assessing Risk Tolerance

- Investors can assess risk tolerance by considering their investment goals, time horizon, financial situation, and emotional capacity to handle market fluctuations.

- Tools like risk assessment questionnaires and discussions with financial advisors can help investors determine their risk tolerance level.

- Understanding risk tolerance is crucial for building a portfolio that aligns with an investor’s comfort level and long-term objectives.

Importance of Periodic Portfolio Rebalancing

- Periodic portfolio rebalancing involves adjusting the asset allocation to maintain the desired risk-return profile.

- Rebalancing ensures that the portfolio stays aligned with the investor’s goals and risk tolerance, especially during market fluctuations.

- By rebalancing regularly, investors can capitalize on opportunities, reduce risks, and avoid overexposure to certain assets.

Role of Asset Allocation

- Asset allocation is the distribution of investments across different asset classes like stocks, bonds, and cash equivalents.

- It plays a crucial role in determining the overall risk and return characteristics of a portfolio.

- Proper asset allocation can help investors achieve diversification, manage risks, and optimize returns based on their investment objectives.

In conclusion, Diversification in Investing is a powerful tool that can help investors navigate the complexities of the financial markets. By spreading investments across different asset classes and managing risk effectively, individuals can work towards achieving their desired financial objectives with confidence and stability.

Frequently Asked Questions

What is the main purpose of diversification in investing?

Diversification helps spread risk across different investments, reducing the impact of any one investment underperforming.

How can diversification assist in achieving long-term financial goals?

By diversifying across various asset classes, investors can enhance portfolio stability and increase the likelihood of meeting long-term financial objectives.

What are some common strategies for effectively diversifying a portfolio?

Strategies include investing in different industries, regions, and types of assets to minimize correlation and maximize returns.