Embark on a journey into the world of portfolio management tools with a focus on clarity and effectiveness. Learn about the best tools available and how they can revolutionize your financial management strategies.

Introduction to Portfolio Management Tools

Portfolio management tools are software or platforms designed to help investors manage their investment portfolios effectively. These tools play a crucial role in financial management by providing investors with the necessary data and analysis to make informed decisions about their investments.

Using portfolio management tools offers several benefits to investors. Firstly, these tools allow investors to track their investments in real-time, providing up-to-date information on the performance of their assets. This real-time tracking helps investors make timely adjustments to their portfolios based on market trends and changes.

Importance of Portfolio Management Tools

Portfolio management tools help investors in tracking their investments effectively by providing detailed insights into the performance of individual assets as well as the overall portfolio. These tools use various metrics and analytics to assess the risk and return of investments, enabling investors to make informed decisions and optimize their portfolios for better returns.

Types of Portfolio Management Tools

Portfolio management tools come in various forms, each catering to different needs and preferences of investors. Let’s explore the different types available in the market.

Automated Portfolio Management Tools

Automated portfolio management tools, also known as robo-advisors, use algorithms and computer programs to create and manage investment portfolios. These tools analyze a client’s financial situation, risk tolerance, and investment goals to recommend a diversified portfolio of assets. They automatically rebalance the portfolio and make adjustments based on market conditions without the need for human intervention.

Traditional Manual Tools

Traditional manual tools involve human investment managers who personally oversee and make decisions regarding the composition of investment portfolios. These managers rely on their expertise, market research, and analysis to construct and maintain portfolios. While manual tools offer a personal touch and customized approach, they can be more time-consuming and may come with higher fees compared to automated tools.

Robo-Advisors Changing the Landscape

Robo-advisors have revolutionized the portfolio management industry by making investing more accessible and affordable to a wider range of investors. These tools have democratized investing by offering low-cost solutions and eliminating the barriers to entry traditionally associated with wealth management services. Robo-advisors provide passive, rules-based investment strategies that appeal to individuals seeking a hands-off approach to managing their portfolios.

Features to Look for in Portfolio Management Tools

When choosing a portfolio management tool, it is important to consider key features that can make your investment management more effective. These features can help you track and analyze your investments in real-time, as well as customize and personalize your portfolio according to your preferences.

Real-Time Data Tracking and Analysis

Real-time data tracking and analysis are essential features in portfolio management tools as they allow you to monitor the performance of your investments instantly. This feature provides up-to-date information on market trends, stock prices, and portfolio performance, helping you make informed decisions quickly.

- Receive live updates on stock prices and market movements

- Analyze your portfolio performance in real-time

- Access historical data and trends for better decision-making

Customization and Personalization Options

Customization and personalization options in portfolio management software enable you to tailor your investment strategy to meet your specific goals and preferences. This feature allows you to create personalized reports, set alerts for certain criteria, and adjust your portfolio based on your risk tolerance and investment objectives.

- Create customized reports and dashboards for easy analysis

- Set alerts for price changes, news updates, and portfolio performance

- Adjust your portfolio allocation based on your risk tolerance and investment goals

Popular Portfolio Management Tools in the Market

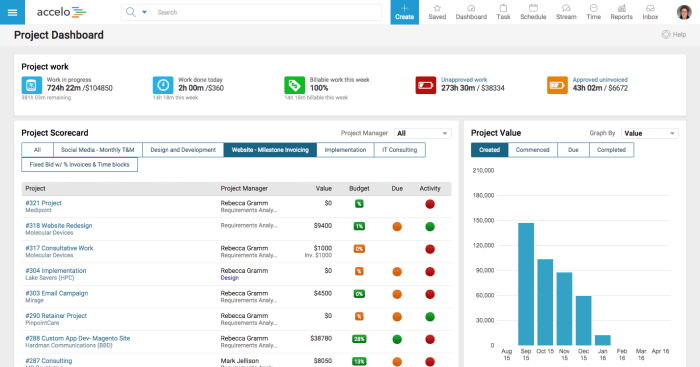

When it comes to managing your investments effectively, having the right portfolio management tool can make all the difference. Let’s take a look at some of the best options available in the market today, along with their key features, pricing, and target users.

Personal Capital

Personal Capital is a popular portfolio management tool that offers a comprehensive suite of features for users looking to track and manage their investments. With Personal Capital, you can link all your financial accounts, track your net worth, analyze your portfolio allocation, and even get personalized investment advice.

- Features: Account aggregation, portfolio analysis, retirement planning tools

- Pricing: Free for basic features, paid advisory services available

- Target Users: Individuals looking for a holistic approach to financial management

Wealthfront

Wealthfront is an automated investment service that uses algorithms to manage your portfolio and optimize your returns. This tool offers features like tax-loss harvesting, rebalancing, and automatic deposits to help you grow your wealth over time.

- Features: Automated investing, tax-efficient strategies, low fees

- Pricing: 0.25% annual advisory fee

- Target Users: Investors seeking a hands-off approach to portfolio management

Betterment

Betterment is another popular choice for individuals looking to invest their money wisely. This tool offers goal-based investing, tax-efficient strategies, and a user-friendly interface that makes it easy to get started with investing.

- Features: Goal-based investing, tax-loss harvesting, automatic rebalancing

- Pricing: 0.25%

-0.40% annual advisory fee - Target Users: Beginner investors or those looking for a simple and intuitive platform

Portfolio Diversification Strategies

Portfolio diversification is the practice of spreading investments across different asset classes, industries, and geographic regions to reduce risk. Diversification is essential in risk management as it helps minimize the impact of a decline in any one investment on the overall portfolio.

Types of Portfolio Diversification Strategies

There are several strategies for diversifying an investment portfolio:

- Asset Allocation: This involves dividing investments among different asset classes such as stocks, bonds, and cash equivalents.

- Industry Diversification: Investing in companies from various industries to reduce sector-specific risks.

- Geographic Diversification: Spreading investments across different countries or regions to minimize country-specific risks.

- Market Capitalization Diversification: Investing in companies of varying sizes, from small-cap to large-cap, to balance growth potential and risk.

- Time Horizon Diversification: Allocating investments based on different time horizons, such as short-term, medium-term, and long-term goals.

Portfolio management tools play a crucial role in implementing and monitoring diversification strategies effectively. These tools provide insights into the current asset allocation, sector exposure, geographical spread, and other key metrics to ensure a well-diversified portfolio. By using these tools, investors can make informed decisions to rebalance their portfolios and optimize diversification for better risk management.

Portfolio Management Techniques

Portfolio management techniques are essential for investors to effectively manage their investments and achieve their financial goals. Two widely used techniques in portfolio management are Modern Portfolio Theory and Risk Parity.

Modern Portfolio Theory

Modern Portfolio Theory, developed by Harry Markowitz, emphasizes the importance of diversification in maximizing returns while minimizing risk. This theory suggests that investors can construct an optimal portfolio by considering the correlation between different assets.

- Modern Portfolio Theory advocates for investing in a mix of assets with low correlation to reduce overall portfolio risk.

- By using portfolio management tools that analyze historical data and correlations, investors can implement Modern Portfolio Theory to build diversified portfolios.

- Successful portfolio management strategies based on Modern Portfolio Theory include allocating assets based on risk tolerance and expected returns, leading to a well-balanced and efficient portfolio.

Risk Parity

Risk Parity is a portfolio management technique that aims to allocate capital based on risk levels rather than traditional asset allocation methods. This approach focuses on balancing risk contributions from different asset classes.

Risk Parity strategy involves equalizing risk across various asset classes, such as equities, fixed income, and commodities, to achieve a more stable and consistent return.

- By utilizing portfolio management tools that assess risk metrics and correlations, investors can apply Risk Parity to create portfolios with optimized risk-adjusted returns.

- Successful portfolio management strategies utilizing Risk Parity involve adjusting asset allocations dynamically based on changing market conditions and risk profiles, resulting in a more robust and resilient portfolio.

In conclusion, mastering the art of portfolio management tools is key to successful financial planning. With the right tools at your disposal, you can navigate the complexities of investment with confidence and precision.

Top FAQs

What are the key benefits of using portfolio management tools?

Portfolio management tools help investors track their investments effectively, make informed decisions, and optimize their portfolios for better returns.

How do robo-advisors impact the landscape of portfolio management tools?

Robo-advisors have automated and streamlined the investment process, making it more accessible and cost-effective for investors to manage their portfolios.

What features should one look for in portfolio management tools?

Key features to consider include real-time data tracking, analysis capabilities, customization options, and user-friendly interfaces.

Can portfolio management tools assist in implementing diversification strategies?

Yes, these tools help investors diversify their portfolios by providing insights, tracking performance, and suggesting suitable investment options for a well-rounded portfolio.