Embark on a journey into the world of investing with Best Diversified Investment Portfolios leading the way, where strategic diversification holds the key to financial success.

Learn about different asset classes, risk management, and portfolio diversification strategies to optimize your investments.

Best Diversified Investment Portfolios

Diversified investment portfolios involve spreading your investments across various asset classes to reduce risk and optimize returns.

Examples of Asset Classes

- Stocks: Investing in shares of publicly traded companies.

- Bonds: Loans made to governments or corporations in exchange for periodic interest payments.

- Real Estate: Owning properties for rental income or capital appreciation.

- Commodities: Investing in physical goods like gold, oil, or agricultural products.

- Alternative Investments: Hedge funds, private equity, or venture capital.

Benefits of Diversified Portfolios

- Reduced Risk: Diversification helps mitigate the impact of market volatility on your overall portfolio.

- Enhanced Returns: By spreading investments across different asset classes, you can take advantage of various market opportunities.

- Stability: Diversified portfolios tend to be more stable over time compared to concentrated investments in a single asset class.

Importance of Risk Management

Risk management is crucial in diversified portfolios to protect your investments from unexpected events. By diversifying across assets with different risk profiles, you can minimize the impact of any single asset’s poor performance on your overall portfolio. Regular monitoring and rebalancing are essential to ensure that your portfolio remains aligned with your financial goals and risk tolerance.

Portfolio Diversification

Portfolio diversification is a risk management strategy that involves spreading your investments across different asset classes, industries, and geographical regions. The goal is to minimize risk by not putting all your eggs in one basket. Diversification is essential in investment because it helps reduce the impact of volatility in one particular investment on the overall portfolio.

Strategies for Achieving Portfolio Diversification

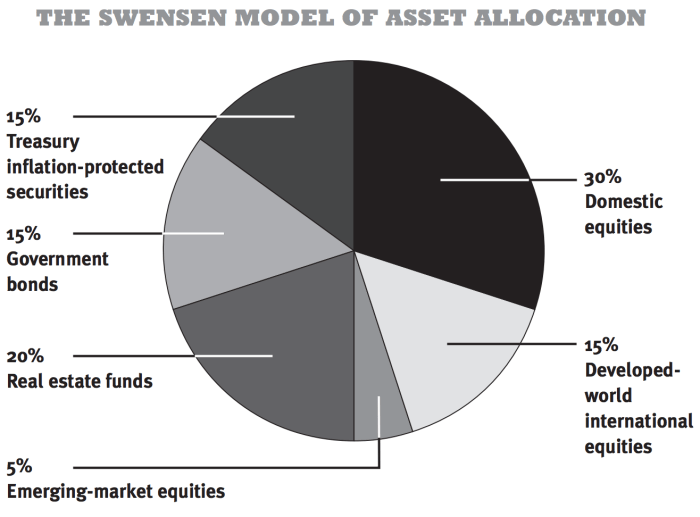

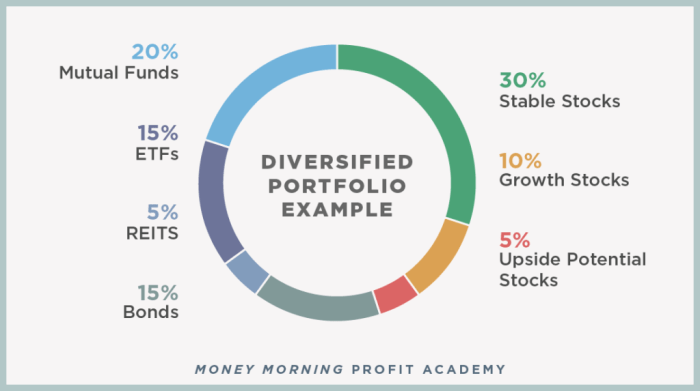

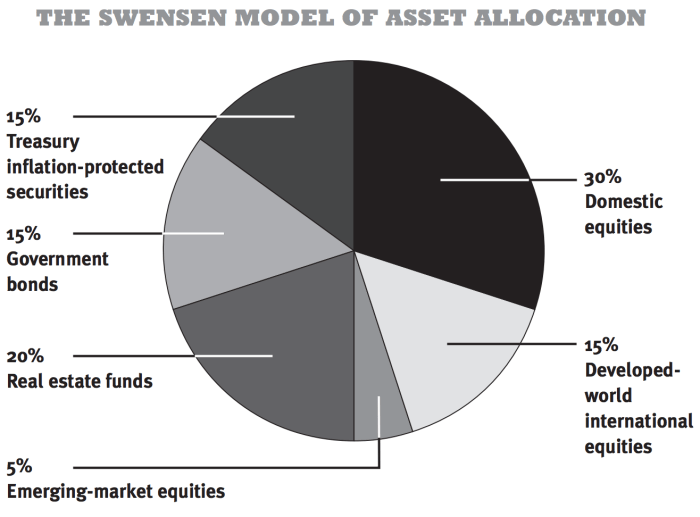

- Invest in different asset classes such as stocks, bonds, real estate, and commodities.

- Diversify across industries to avoid concentration risk in a specific sector.

- Allocate investments globally to reduce exposure to regional economic downturns.

- Consider alternative investments like hedge funds or private equity for added diversification.

Impact of Diversification on Overall Portfolio Performance

Diversification can help improve the risk-adjusted return of a portfolio by reducing the overall volatility. While it may limit the potential for outsized gains from a single investment, it also protects the portfolio from significant losses if one investment underperforms.

Examples of How Diversification Can Help Mitigate Risks

- During a market downturn, a well-diversified portfolio may see losses in one asset class offset by gains in another.

- If a particular industry faces a crisis, diversified investments in other sectors can help cushion the impact on the overall portfolio.

- Geographical diversification can protect against localized economic challenges that may negatively affect investments in a specific region.

Portfolio Management

Portfolio management plays a crucial role in maintaining diversified investments by overseeing the allocation of assets within a portfolio to achieve the investor’s financial goals while managing risk.

Key Elements of Effective Portfolio Management

- Asset Allocation: Determining the right mix of assets based on the investor’s risk tolerance, time horizon, and financial objectives.

- Diversification: Spreading investments across different asset classes, industries, and regions to reduce risk exposure.

- Risk Management: Monitoring and evaluating the level of risk in the portfolio and implementing strategies to mitigate potential losses.

- Regular Review: Continuously assessing the performance of investments and making adjustments as needed to align with the investor’s goals.

Monitoring and Adjusting a Diversified Investment Portfolio

It is essential to regularly monitor and adjust a diversified investment portfolio to ensure it remains aligned with the investor’s objectives and risk tolerance. Here are some tips:

- Review Performance: Periodically evaluate the performance of each investment in the portfolio to identify underperforming assets.

- Rebalance Asset Allocation: Adjust the allocation of assets to maintain the desired level of diversification and risk exposure.

- Stay Informed: Stay updated on market trends, economic conditions, and geopolitical events that may impact the portfolio.

Importance of Rebalancing Portfolios Regularly

Rebalancing portfolios regularly is crucial to ensure that the asset allocation remains in line with the investor’s risk tolerance and financial goals. It helps to:

- Control Risk: Rebalancing helps to control risk by preventing the portfolio from becoming too heavily weighted in a particular asset class.

- Maximize Returns: By reallocating assets based on their performance, investors can potentially maximize returns and achieve long-term growth.

As we conclude our exploration of Best Diversified Investment Portfolios, remember that a well-diversified portfolio is essential for long-term financial growth and stability.

Common Queries

What is the significance of diversification in investment portfolios?

Diversification helps reduce risk by spreading investments across different asset classes.

How often should I rebalance my diversified investment portfolio?

Rebalancing should be done periodically, typically annually, to ensure your portfolio aligns with your investment goals.