Embark on a journey through the realm of Asset Allocation for Diversification, where strategic investment decisions pave the way for a well-rounded portfolio. Discover the art of balancing risk and reward to maximize returns and safeguard your investments.

Explore the intricacies of asset classes, diversification benefits, and proven strategies that lead to financial success in the dynamic world of investment management.

Asset Allocation for Diversification

Asset allocation is the strategy of spreading investments across different asset classes to achieve diversification. Diversification is essential to reduce risk and optimize returns by avoiding overexposure to any single asset class. Let’s explore the concept further.

Asset Classes Suitable for Diversification

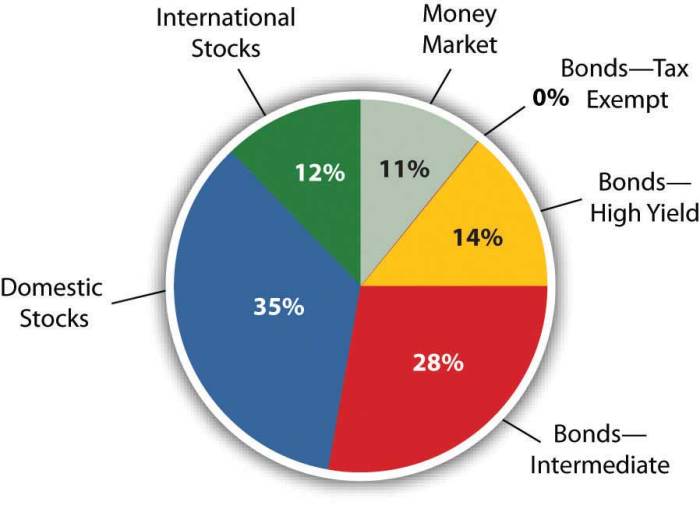

Asset classes suitable for diversification include stocks, bonds, real estate, commodities, and cash equivalents. Each asset class has its own risk and return characteristics, allowing investors to create a well-balanced portfolio.

Benefits of Diversification in Reducing Investment Risk

Diversification helps reduce the overall risk in a portfolio by spreading investments across different assets. When one asset class underperforms, others may perform better, balancing out the overall returns and minimizing losses.

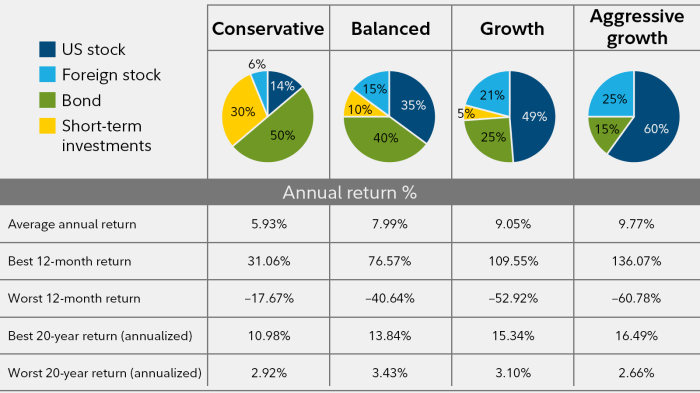

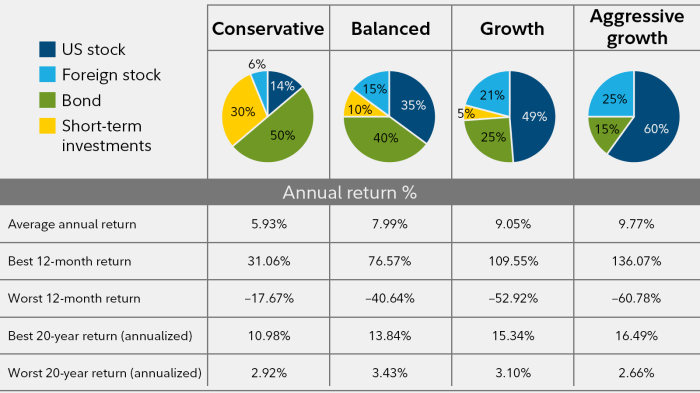

Examples of Asset Allocation Strategies for Achieving Diversification

- Modern Portfolio Theory: This strategy involves creating a diversified portfolio based on the correlation between different asset classes to achieve the optimal risk-return balance.

- Age-Based Asset Allocation: Investors can adjust their asset allocation based on their age, with younger investors focusing more on growth assets like stocks and gradually shifting to more conservative assets like bonds as they approach retirement.

- Equal Weighted Allocation: Allocating an equal amount of funds to each asset class can help maintain a balanced portfolio and reduce dependence on any single asset for returns.

Portfolio Diversification

Portfolio diversification is a fundamental concept in investment management that involves spreading investments across different asset classes to reduce risk and enhance overall portfolio performance.

Significance of Portfolio Diversification

Portfolio diversification is crucial as it helps in mitigating the impact of market fluctuations on the overall investment portfolio. By investing in a mix of assets such as stocks, bonds, real estate, and commodities, investors can reduce the risk of significant losses if one asset class underperforms.

Spreading Risk Across Different Investments

Diversification allows investors to spread their risk across different investments, reducing the impact of any single investment’s poor performance on the entire portfolio. This strategy helps in minimizing losses and maintaining a more stable return over time.

Correlation Between Asset Classes and Impact on Portfolio Diversification

Understanding the correlation between asset classes is essential for effective portfolio diversification. Ideally, investors should choose assets that have a low or negative correlation with each other. This way, when one asset class is performing poorly, another may be performing well, balancing out the overall portfolio returns.

Enhancing Portfolio Performance through Diversification

By diversifying their investments, investors can potentially enhance their portfolio performance. For example, a portfolio that includes a mix of high-risk, high-return assets like stocks, along with low-risk, stable assets like bonds, can achieve a balance of risk and return that aligns with an investor’s goals and risk tolerance. Diversification can lead to a more consistent and predictable investment outcome over the long term.

Portfolio Management

Portfolio management plays a crucial role in optimizing investment portfolios by strategically allocating resources to achieve financial goals while managing risk. It involves the process of constructing and maintaining a well-diversified investment portfolio to maximize returns and minimize potential losses.

Constructing and Maintaining a Well-Diversified Investment Portfolio

- Determine investment objectives and risk tolerance: Understand your financial goals and how much risk you are willing to take on.

- Asset allocation: Allocate investments across different asset classes such as stocks, bonds, and cash equivalents to spread risk.

- Diversification: Spread investments within each asset class to reduce exposure to individual risks.

- Regular monitoring and rebalancing: Periodically review the portfolio and make adjustments to maintain the desired asset allocation.

Active vs. Passive Portfolio Management Strategies

- Active management: Involves frequent buying and selling of securities in an attempt to outperform the market. Requires extensive research and analysis.

- Passive management: Involves holding a diversified portfolio that mirrors a market index. Aims to match market returns rather than beat them.

Tips for Effective Portfolio Management

- Set clear financial goals and risk tolerance levels.

- Regularly review and adjust your portfolio based on changing market conditions and personal circumstances.

- Consider seeking professional advice from a financial advisor to help with portfolio management.

- Stay informed about market trends and developments to make informed investment decisions.

In conclusion, mastering the art of Asset Allocation for Diversification is the key to unlocking a world of financial opportunities. By diversifying wisely and managing your portfolio effectively, you pave the path to long-term growth and stability in your investments.

FAQ Insights

What are the main benefits of asset allocation for diversification?

Asset allocation helps spread risk across different asset classes, reducing investment vulnerability and increasing the potential for returns.

How can diversification impact portfolio performance?

Diversification can enhance portfolio performance by mitigating risks associated with individual investments and providing a more stable overall return.

What is the difference between active and passive portfolio management strategies?

Active portfolio management involves frequent buying and selling of assets to outperform the market, while passive management aims to match market returns with minimal trading.