Portfolio Management Software sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As businesses strive to maximize their investment potential, the use of Portfolio Management Software emerges as a crucial tool in navigating the complexities of financial management.

Introduction to Portfolio Management Software

Portfolio management software is a tool used by businesses to effectively manage their investment portfolios. It provides a centralized platform for tracking, analyzing, and optimizing investments to achieve financial goals and objectives.

Benefits of Portfolio Management Software

- Efficient Portfolio Tracking: Portfolio management software allows businesses to track all their investments in one place, providing real-time updates on performance and value.

- Risk Management: By analyzing the risk associated with each investment, businesses can make informed decisions to minimize potential losses.

- Performance Analysis: The software offers detailed performance reports and analytics, helping businesses assess the profitability of their investments.

- Diversification Strategies: Portfolio management software assists in creating diversified investment portfolios to spread risk and optimize returns.

Popular Portfolio Management Software

- 1. Aladdin by BlackRock: Widely used by institutional investors, Aladdin offers risk management, portfolio analytics, and trading solutions.

- 2. Bloomberg AIM: Known for its comprehensive asset management capabilities, Bloomberg AIM provides real-time market data and investment tools.

- 3. Charles River IMS: A popular choice for asset managers, Charles River IMS offers trading, compliance, and performance measurement features.

Features of Portfolio Management Software

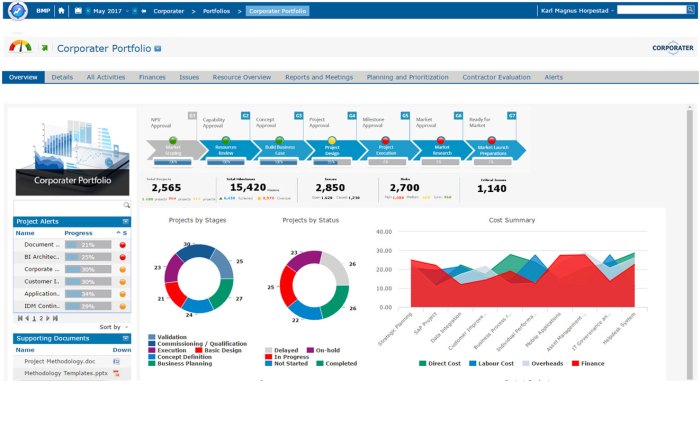

Portfolio management software offers a range of features to help investors organize and track their investments effectively. These features are designed to streamline the investment process and provide valuable insights for decision-making.

Real-Time Portfolio Tracking

- Allows users to track the performance of their investments in real-time.

- Provides up-to-date information on the value of assets, changes in prices, and overall portfolio performance.

- Enables investors to make informed decisions based on current market conditions.

Asset Allocation Tools

- Helps investors allocate their assets across different investment options.

- Provides guidance on diversification strategies to minimize risk.

- Allows users to set target allocations and rebalance portfolios as needed.

Risk Management Features

- Identifies and analyzes potential risks associated with investments.

- Offers tools to assess risk tolerance and adjust investment strategies accordingly.

- Provides alerts for portfolio deviations from set risk parameters.

Performance Reporting

- Generates detailed reports on portfolio performance, including returns, gains, and losses.

- Compares portfolio performance against benchmarks and goals.

- Offers customizable reporting options for different stakeholders.

Tax Optimization Tools

- Helps investors minimize tax liabilities through tax-efficient investing strategies.

- Offers tools to calculate tax implications of investment decisions.

- Provides tax-loss harvesting capabilities to offset gains with losses.

Importance of Portfolio Diversification

Portfolio diversification is a strategy used by investors to reduce risk by spreading their investments across different asset classes, industries, and geographic regions. This helps in minimizing the impact of volatility in any single investment on the overall portfolio.

Benefits of Portfolio Diversification

- Diversification helps in mitigating unsystematic risk, which is the risk specific to a particular company or industry. By investing in a variety of assets, investors can reduce the impact of adverse events on their portfolio.

- It also helps in optimizing returns by capturing the performance of different assets that may perform well in varying market conditions. This can lead to a more stable and consistent growth in the long term.

- Portfolio diversification can enhance the risk-adjusted return of a portfolio, as it aims to balance the risk and return profile based on the investor’s goals and risk tolerance.

Strategies for Effective Portfolio Diversification

- Asset Allocation: Allocate investments across different asset classes such as stocks, bonds, real estate, and commodities based on the risk-return profile of each asset.

- Industry Diversification: Spread investments across various industries to reduce exposure to sector-specific risks. This ensures that the portfolio is not heavily influenced by the performance of a single sector.

- Geographic Diversification: Invest in assets from different countries and regions to minimize the impact of economic and political events specific to a single country.

- Rebalancing: Regularly review and adjust the portfolio to maintain the desired asset allocation and risk profile. Rebalancing ensures that the portfolio remains diversified and aligned with the investor’s goals.

Portfolio Management Strategies

Portfolio management strategies play a crucial role in achieving investment goals and managing risk effectively. Two common approaches to portfolio management are active management and passive management.

Active vs. Passive Management

- Active Management: In active management, portfolio managers aim to outperform the market by making frequent buying and selling decisions. This approach involves in-depth research, market analysis, and timing the market to capitalize on opportunities.

- Passive Management: Passive management, on the other hand, involves tracking a specific market index or benchmark. Instead of trying to beat the market, passive managers focus on replicating the performance of the index. This approach typically involves lower costs and less frequent trading.

Role of Asset Allocation and Rebalancing

Asset allocation refers to the distribution of investments across different asset classes such as stocks, bonds, and cash equivalents. It is a critical component of portfolio management as it helps in diversifying risk and maximizing returns based on the investor’s risk tolerance and investment objectives.

Rebalancing involves periodically adjusting the asset allocation to maintain the desired risk-return profile. This ensures that the portfolio stays aligned with the investor’s goals and helps in mitigating risks associated with market fluctuations.

Role of Software in Implementing and Monitoring Strategies

Portfolio management software plays a key role in implementing and monitoring these strategies effectively. These tools provide features such as portfolio tracking, performance analysis, risk assessment, and scenario modeling to help investors make informed decisions.

By leveraging software, investors can automate tasks like asset allocation, rebalancing, and monitoring, saving time and ensuring more efficient portfolio management. Additionally, these tools offer real-time data and insights, enabling investors to stay informed and react promptly to market changes.

In conclusion, Portfolio Management Software serves as a cornerstone for effective investment strategies, empowering businesses to make informed decisions and optimize their portfolios with confidence.

FAQ Summary

What is the primary purpose of Portfolio Management Software?

Portfolio Management Software is designed to help businesses organize, track, and optimize their investments effectively.

How does portfolio diversification impact investment management?

Portfolio diversification helps reduce risk by spreading investments across different asset classes, lowering the overall impact of market fluctuations.

What are some common features found in Portfolio Management Software?

Common features include investment tracking, performance analysis, risk assessment, and portfolio optimization tools.