Exploring the world of Portfolio Diversification and Risk, this introduction sets the stage for a deep dive into strategies that can enhance your investment journey. From understanding asset classes to managing risks, get ready to elevate your portfolio game.

As we delve further, you’ll uncover the intricacies of risk management, the significance of asset allocation, and effective diversification strategies that pave the way for financial success.

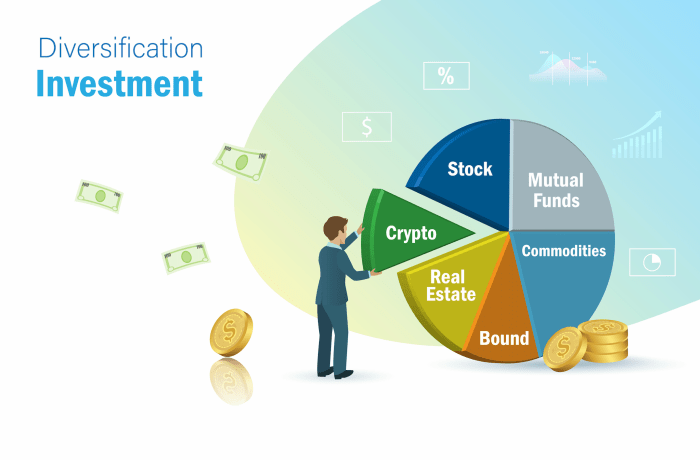

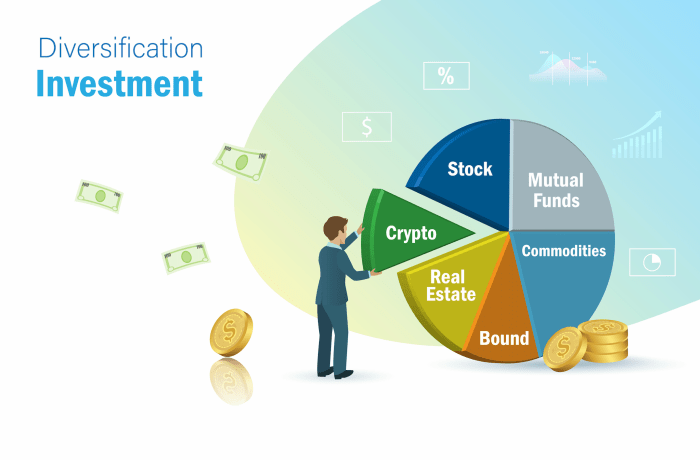

Portfolio Diversification

Portfolio diversification is a strategy that involves investing in a mix of different asset classes within a portfolio to spread risk and minimize exposure to any single asset or risk factor. By diversifying, investors aim to achieve a balance between risk and return.

Asset Classes in a Diversified Portfolio

- Stocks: Investing in shares of companies, providing potential for growth.

- Bonds: Fixed-income securities issued by governments or corporations, offering regular interest payments.

- Real Estate: Investing in properties or Real Estate Investment Trusts (REITs) for rental income and potential appreciation.

- Commodities: Investing in physical goods like gold, silver, oil, or agricultural products for diversification.

- Cash Equivalents: Including money market funds or certificates of deposit for liquidity and stability.

Benefits of Portfolio Diversification in Risk Management

Diversification helps in spreading risk across different investments, reducing the impact of a single investment’s poor performance on the overall portfolio. By including various asset classes, investors can benefit from the potential growth of different sectors while minimizing losses in case of a downturn in one sector.

Reducing Volatility through Diversification

Diversification can help reduce volatility in investments by offsetting losses in one asset class with gains in another. For example, when stocks are experiencing a downturn, bonds or real estate investments may provide stability and act as a hedge. This balanced approach can help smooth out the overall performance of the portfolio over time.

Risk Management in Portfolio Diversification

When it comes to portfolio diversification, risk management plays a crucial role in ensuring that an investor’s overall risk exposure is minimized. By spreading investments across different asset classes, industries, and geographical regions, investors can reduce the impact of any negative events on their portfolio.Diversification helps in mitigating various types of risks, including market risk, systematic risk, unsystematic risk, and concentration risk.

Here’s how diversification helps in managing these risks:

Market Risk:

- Diversifying across different asset classes such as stocks, bonds, and real estate can help reduce the impact of market fluctuations on the overall portfolio.

- For example, if the stock market experiences a downturn, investments in bonds or alternative assets may perform better, balancing out the losses.

Systematic Risk:

- Systematic risk refers to risks that affect the entire market, such as interest rate changes or economic downturns.

- By diversifying globally and across industries, investors can reduce their exposure to systematic risks specific to a particular market or sector.

Unsystematic Risk:

- Unsystematic risk, also known as specific risk, is the risk associated with individual assets or companies.

- Diversification across different companies within the same industry can help mitigate unsystematic risk by spreading investments across multiple securities.

Concentration Risk:

- Concentration risk occurs when a portfolio is heavily weighted towards a single asset or asset class.

- By diversifying investments, investors can avoid concentration risk and reduce the impact of poor performance from a single investment on the overall portfolio.

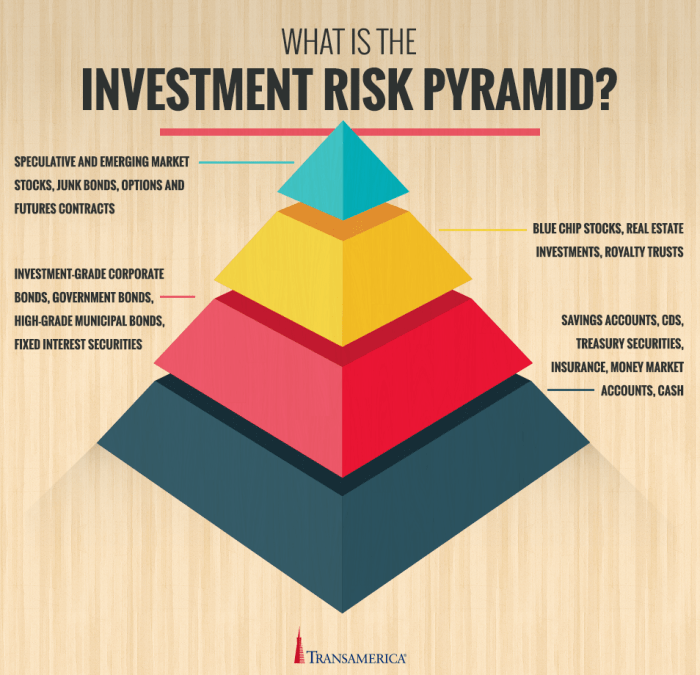

Importance of Asset Allocation

Asset allocation plays a crucial role in portfolio diversification by determining how an investor distributes their investments among different asset classes, such as stocks, bonds, and cash equivalents. It is a strategic approach that aims to optimize the risk-return profile of a portfolio based on an individual’s investment goals, risk tolerance, and time horizon.

Asset Allocation Strategies for Risk Management

Asset allocation strategies help in managing risk by spreading investments across various asset classes that do not move in perfect correlation with each other. This diversification reduces the overall risk of the portfolio, as losses in one asset class may be offset by gains in another. By strategically allocating assets, investors can mitigate the impact of market volatility and reduce the likelihood of significant losses.

Impact of Asset Allocation on Portfolio Performance

Asset allocation has a significant impact on the overall performance of a portfolio. Studies have shown that asset allocation is responsible for a significant portion of the variability in a portfolio’s returns over time. By choosing the right mix of assets based on their historical performance and expected future returns, investors can enhance the performance of their portfolio while minimizing risk.

Examples of Asset Allocation Models

| Asset Allocation Model | Risk-Return Profile |

|---|---|

| Aggressive | High risk, high potential return |

| Moderate | Moderate risk, moderate return |

| Conservative | Low risk, low return |

Strategies for Portfolio Diversification

Portfolio diversification is a key strategy for managing risk and maximizing returns in investment portfolios. By spreading investments across different asset classes, industries, and geographical regions, investors can reduce the impact of market fluctuations on their overall portfolio performance.

Passive vs. Active Portfolio Management

Passive portfolio management involves investing in a diversified mix of assets that mirror a specific market index, such as the S&P 500. This approach aims to match the performance of the market rather than beat it. On the other hand, active portfolio management involves hands-on decision-making by fund managers to outperform the market through strategic buying and selling of securities.

- Passive Management:

Passive management is typically characterized by lower fees and less frequent trading activity, making it a cost-effective option for long-term investors.

- Active Management:

Active management offers the potential for higher returns but comes with higher fees and the risk of underperforming the market.

Rebalancing for Portfolio Maintenance

Rebalancing is the process of adjusting the asset allocation in a portfolio back to its target percentages. This helps maintain diversification and ensures that the portfolio is aligned with the investor’s risk tolerance and financial goals.

- Regular Rebalancing:

Regularly reviewing and rebalancing a portfolio can help prevent overexposure to certain assets and maintain the desired risk-return profile.

- Threshold-Based Rebalancing:

Setting thresholds for asset allocation percentages can trigger rebalancing when deviations exceed a certain level, ensuring that the portfolio stays diversified.

Tips for Creating a Well-Diversified Portfolio

Building a well-diversified investment portfolio requires careful consideration of asset classes, risk profiles, and investment goals. Here are some tips to achieve effective diversification:

- Asset Allocation:

Diversify across asset classes such as stocks, bonds, real estate, and commodities to reduce risk and enhance returns.

- Global Diversification:

Invest in international markets to mitigate country-specific risks and take advantage of growth opportunities in different regions.

- Correlation Analysis:

Consider the correlation between assets to ensure they do not move in the same direction during market fluctuations, enhancing diversification benefits.

- Risk Management:

Implement risk management strategies such as stop-loss orders and position sizing to protect capital and minimize losses in volatile markets.

In conclusion, Portfolio Diversification and Risk go hand in hand to create a robust investment approach. By diversifying your assets wisely and managing risks effectively, you pave the way for a more secure financial future.

Question Bank

What are the key benefits of portfolio diversification?

Portfolio diversification helps in reducing risk by spreading investments across different asset classes, thereby minimizing the impact of market fluctuations on your overall portfolio.

How does asset allocation impact portfolio performance?

Asset allocation plays a crucial role in determining the risk-return profile of your portfolio. By strategically allocating assets based on your goals and risk tolerance, you can optimize performance while managing risk effectively.

What are the differences between passive and active portfolio management?

Passive management involves tracking a market index, while active management entails more hands-on decision-making to outperform the market. Both approaches have their pros and cons, depending on your investment objectives.