Embark on a journey of financial growth with Building a Diversified Portfolio, where we delve into the art of balancing risks and rewards to optimize your investment potential.

Explore the realm of diversified portfolios and unlock the secrets to achieving stability and growth in your financial ventures.

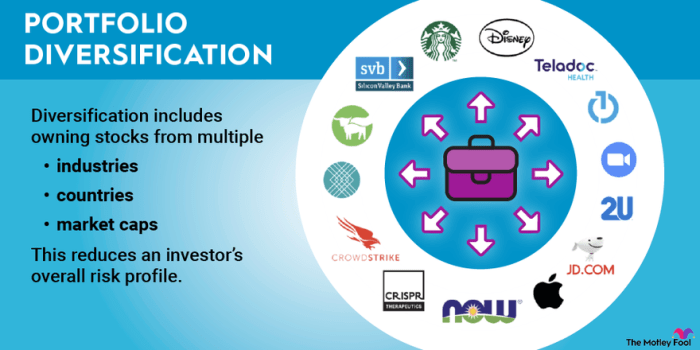

PORTFOLIO DIVERSIFICATION

Portfolio diversification is a strategy that involves spreading your investments across different asset classes to reduce risk. It is crucial in investment because it helps to minimize the impact of market volatility on your overall portfolio. Diversification can provide more stable returns over time and protect your investments from significant losses.

Asset Classes in a Diversified Portfolio

- Stocks: Investing in shares of companies represents ownership in a business and can offer potential growth.

- Bonds: Fixed-income securities that provide regular interest payments and can add stability to a portfolio.

- Real Estate: Investing in properties or real estate investment trusts (REITs) can diversify your portfolio with physical assets.

- Commodities: Including assets like gold, oil, or agricultural products can hedge against inflation and economic uncertainties.

- Cash Equivalents: Holding cash or money market instruments can provide liquidity and act as a safe haven during market downturns.

Risks of Lack of Portfolio Diversification

Not diversifying your portfolio exposes you to concentration risk, where a significant portion of your investments are tied to a single asset or asset class. This can lead to higher volatility and potential losses if that particular investment underperforms. By spreading your investments across various assets, you can reduce this risk and protect your overall wealth.

Impact of Diversification on Risk Management and Returns

Diversification plays a crucial role in risk management by ensuring that the negative performance of one asset does not heavily impact the entire portfolio. While diversification may not eliminate all risks, it can help in minimizing the overall risk exposure. Additionally, a well-diversified portfolio can potentially enhance returns by capturing growth opportunities in different sectors or industries, balancing out losses, and improving the overall risk-return profile.

PORTFOLIO MANAGEMENT

Portfolio management is the process of overseeing and optimizing an investment portfolio to achieve the investor’s financial goals while managing risk. It involves making decisions about asset allocation, diversification, buying and selling securities, and monitoring performance. Effective portfolio management is crucial for maintaining a healthy and balanced investment portfolio over time.

Strategies for Effective Portfolio Management

- Rebalancing: Regularly review and adjust the portfolio to maintain the desired asset allocation. Buy or sell assets as needed to bring the portfolio back in line with the target percentages.

- Monitoring: Keep track of the portfolio’s performance, market trends, and changes in the economic environment. Stay informed and make informed decisions based on the latest information.

Active vs. Passive Portfolio Management

- Active Management: Involves frequent buying and selling of securities in an attempt to outperform the market. Requires in-depth research, analysis, and market timing. May incur higher costs due to more frequent trading.

- Passive Management: A more hands-off approach that seeks to match the performance of a specific market index or benchmark. Involves lower costs and less frequent trading. Popular through index funds and ETFs.

Aligning Portfolio Management with Financial Goals and Risk Tolerance

- Define Financial Goals: Clearly establish short-term and long-term financial objectives, such as retirement savings, education funds, or wealth preservation.

- Evaluate Risk Tolerance: Understand your risk tolerance level and investment preferences. Consider factors like age, income, time horizon, and comfort with market fluctuations.

In conclusion, Building a Diversified Portfolio equips you with the tools and knowledge to navigate the complexities of investment, ensuring a secure and prosperous financial future.

Clarifying Questions

What is the importance of portfolio diversification?

Diversification helps spread risk and potentially increase returns by investing in a variety of assets.

How can lack of portfolio diversification be mitigated?

By allocating investments across different asset classes and industries to reduce concentration risk.

What are the benefits of active portfolio management?

Active management allows for quicker adjustments to market conditions and potential higher returns, albeit with higher fees.

How can one align portfolio management with financial goals?

By setting clear objectives, regularly reviewing performance, and adjusting investments to match risk tolerance and objectives.